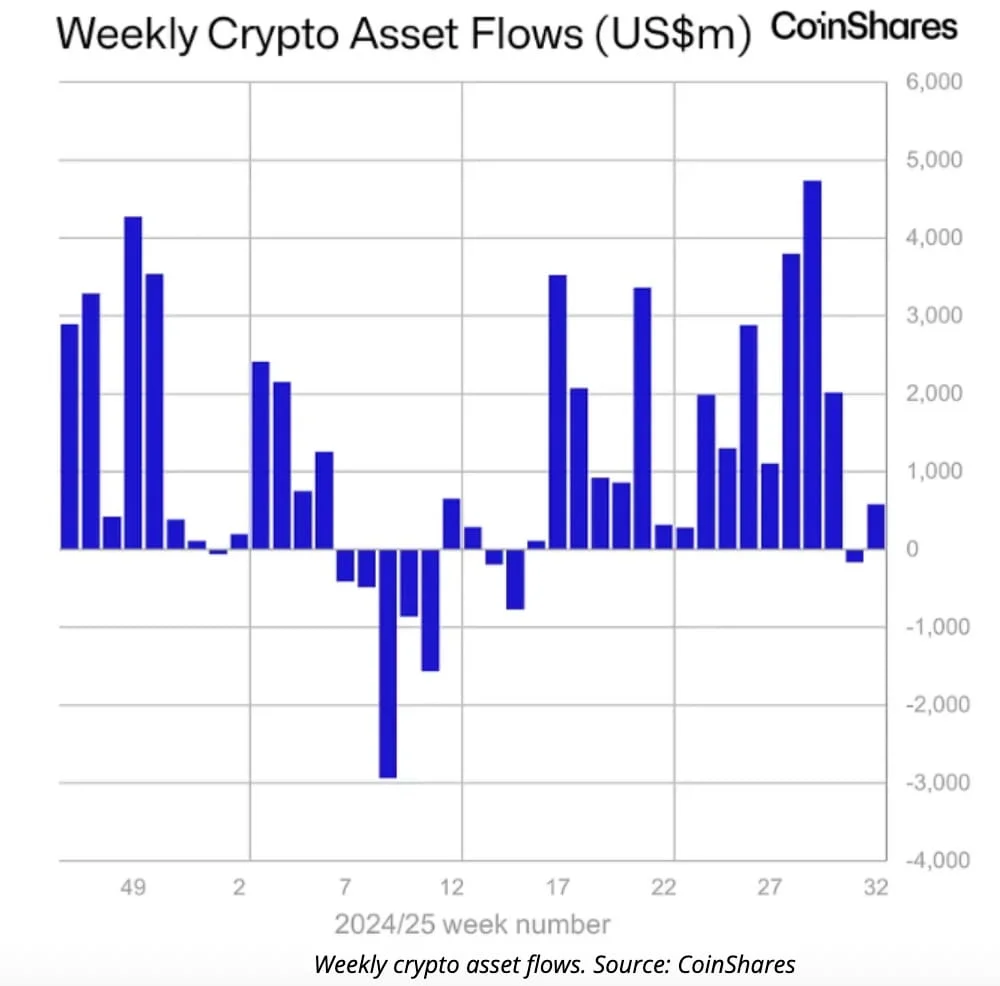

Cryptocurrency investment products made a strong comeback last week after breaking a record 15-week inflow streak that brought in a total of $27.8 billion. The previous week had ended that historic run, but fresh momentum returned to the market.

Data from European crypto asset manager CoinShares shows that global crypto exchange-traded products (ETPs) recorded $572 million in inflows during the trading week ending Friday. This rise in investment interest came alongside a rebound in major cryptocurrencies, with both Bitcoin and Ether seeing price gains.

Ethereum stood out as it touched the $4,000 mark for the first time since December 2024, a key psychological level for traders and investors. This milestone, combined with improving market sentiment, encouraged more investors to put money into crypto-related funds.

$572M Flows Into Crypto as Bitcoin and Ethereum Bounce Back

Global cryptocurrency exchange-traded products (ETPs) had a strong week, with $572 million in new investments, according to CoinShares. This comes after the previous week ended a record 15-week run of inflows worth $27.8 billion.

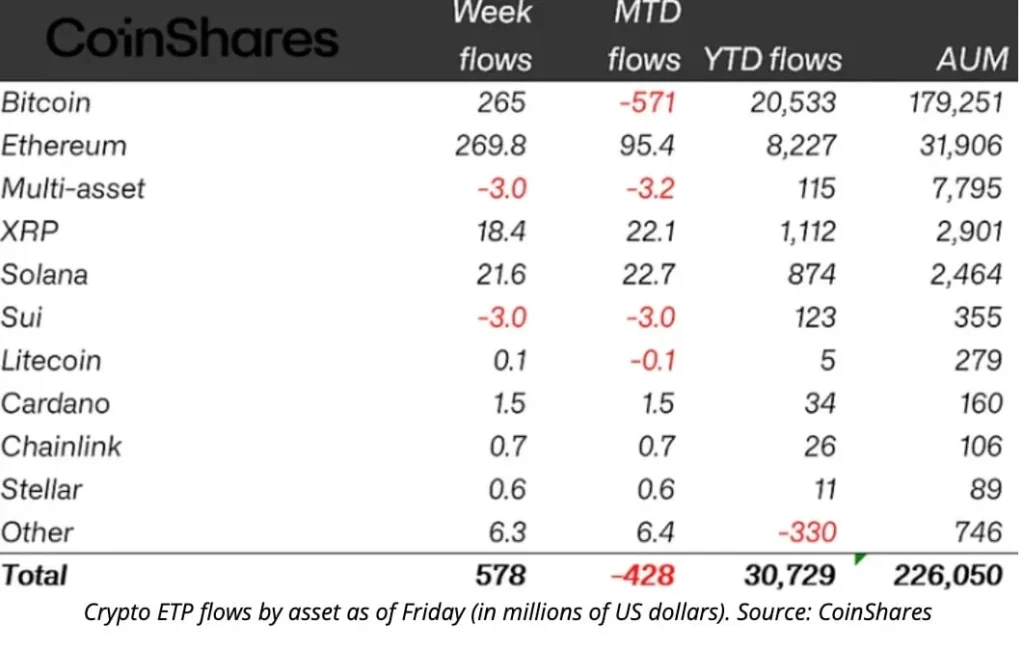

The rebound happened as Bitcoin and Ether prices went up. Ethereum passed $4,000 for the first time since December 2024, and Bitcoin traded above $122,000. The total value of crypto ETPs reached a record $226 billion, and the total inflows for this year so far hit $30.7 billion, the highest ever recorded.

Markets Rise Following 401(k) Approval

Markets rose after the U.S. government approved the use of digital assets in 401(k) retirement plans. James Butterfill, head of research at CoinShares, said this decision led to a surge of investments late in the week.

At the start of the week, cryptocurrency exchange-traded products (ETPs) saw $1 billion in outflows as investors worried about weak U.S. payroll data. But after the policy announcement, confidence returned, and the second half of the week brought $1.57 billion in inflows, marking a sharp turnaround in sentiment.

Ether ETPs Lead with Record Inflows and Strong Market Gains

Ether exchange-traded products (ETPs) stayed ahead of the market last week, attracting the largest inflows among all crypto assets at nearly $270 million. This follows strong growth in July and highlights continued investor interest.

According to James Butterfill from CoinShares, these inflows pushed Ether’s year-to-date total to a record $8.2 billion. Recent price gains have also lifted total assets under management for Ether ETPs to an all-time high of $32.6 billion — up 82% so far this year.

Bitcoin ETPs also rebounded after two weeks of outflows, bringing in $265 million in new investments last week.

Other altcoin ETPs saw smaller but notable inflows, including $21.6 million for Solana (SOL), $18.4 million for XRP (XRP), and $10.1 million for Near (NEAR), showing that investors are diversifying beyond Bitcoin and Ether.

BlackRock on Track for $100B in Crypto AUM

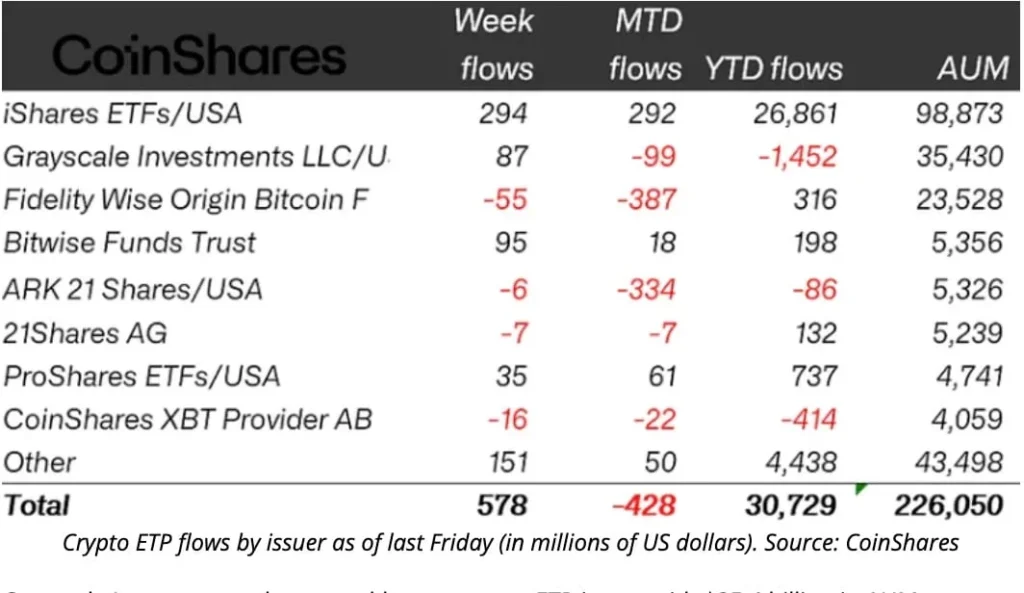

BlackRock’s net crypto assets are getting close to the $100 billion mark. Last week, its iShares crypto exchange-traded funds (ETFs) brought in $294 million in new investments. While this was a drop of about 61% from the previous week’s $749 million, the funds still moved nearer to the milestone, finishing Friday with $98.9 billion in assets under management (AUM).

Grayscale Investments, the second-largest crypto ETP issuer, holds $35.4 billion in AUM and saw $87 million in inflows last week. Bitwise came in just ahead with $95 million in new investments.

On the other hand, Fidelity Investments’ crypto funds experienced the largest outflows among major issuers, with $55 million leaving its products during the week.

The data shows that while inflows slowed, BlackRock remains the clear leader in the crypto ETP market, steadily building toward a record-breaking $100 billion milestone.