Japan has long been a hub of cultural creativity, producing world-famous anime, manga, and gaming franchises. Yet experts estimate that nearly 90 to 99 percent of this intellectual property remains unused, sitting in archives or limited to small licensing deals.

For decades, creators and investors alike have faced challenges in unlocking the true economic value of these assets without losing their cultural essence.

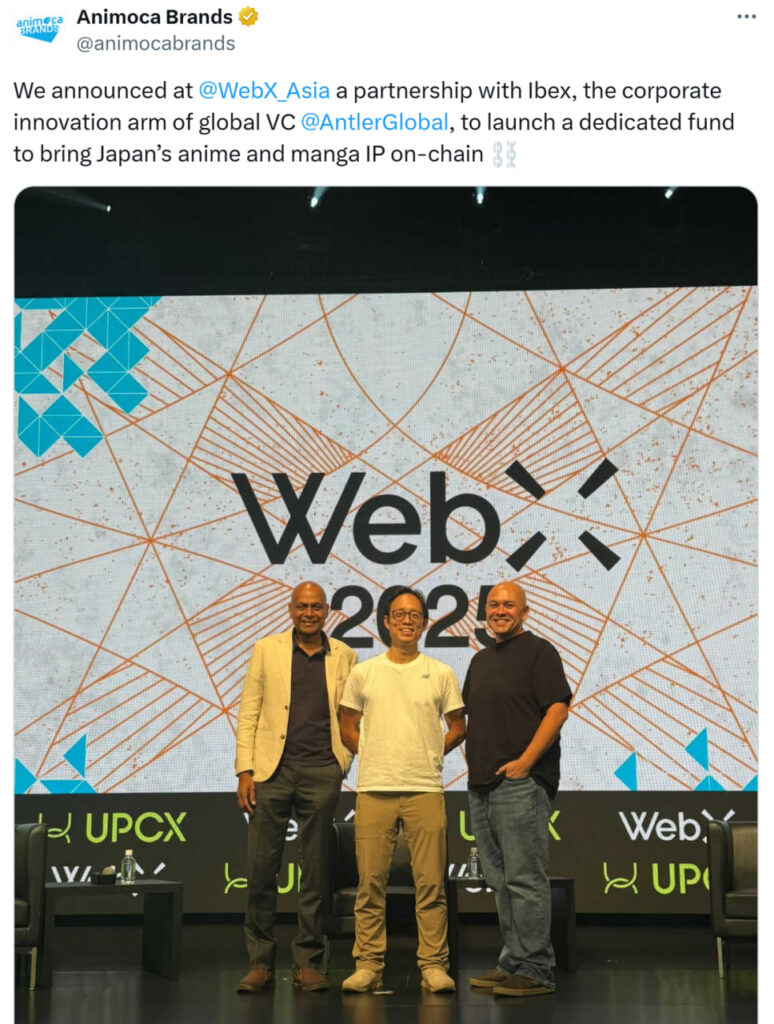

That landscape may be changing with the arrival of blockchain. In July 2025, Animoca Brands partnered with Antler’s Ibex Japan to launch the Ibex Fund, a multi-million dollar initiative focused on tokenizing Japan’s dormant IP.

Unlike traditional licensing, which generates slow and incremental returns, this fund will transform unused anime and manga into blockchain powered assets such as NFTs, gamified experiences, and digital collectibles.

The goal is to create long term value by giving creators ongoing royalties, offering fans ownership of unique digital pieces, and opening a new asset class for investors.

The announcement at WebX Tokyo, Asia’s largest Web3 event, highlights Japan’s growing role in digital asset innovation. With policymakers, including Japan’s Finance Minister, showing greater interest in how crypto fits into modern finance, the Ibex Fund reflects more than just a business strategy.

It represents a cultural shift that blends heritage with blockchain, fandom with finance, and local creativity with global capital.

Main News Coverage

The announcement took place at the WebX Tokyo conference, where Animoca co-founder Yat Siu and Ibex partner Sandeep Casi shared the details. Casi highlighted that Japan’s unused anime and manga rights represent a huge untapped market that blockchain can help unlock.

The new fund will focus on acquiring dormant IP and turning it into NFTs and other digital products. This approach allows creators to continue earning royalties, gives fans the chance to own exclusive digital items, and opens up a new investment market that was previously closed off.

Backed by Antler’s global network, which operates in 22 cities and manages more than 1.2 billion dollars in assets, the Ibex Fund is well positioned to scale worldwide. This reach will help Japanese IP expand beyond local entertainment and connect with international markets, including fintech, medtech, and digital collectibles.

Why Tokenizing Japanese IP Matters

Japanese cultural exports such as anime and manga make up a multi-billion dollar industry with fans across the globe. Yet even with their massive popularity, creators and publishers often face problems like limited revenue streams, piracy, and difficulty in reaching international audiences directly.

Tokenization offers a modern solution by turning characters, storylines, and rights into blockchain-based assets that can be tracked, traded, and monetized securely. For example:

- An anime studio could create NFTs that represent unique artwork, iconic story moments, or limited-edition merchandise.

- Gaming companies could tokenize in-game items, ensuring authenticity and building new secondary markets.

- Manga publishers could use Web3 platforms to enable global microtransactions directly from fans, cutting out traditional distribution barriers.

This initiative also connects with Japan’s ongoing effort to modernize its financial sector. Earlier this year, the launch of Japan’s First Bitcoin XRP Dual ETF showed that the country is carefully moving into crypto-linked financial products. Tokenizing IP continues this progress, placing culture and technology at the center of Japan’s strategy for economic innovation.

Anime to Finance What Can Be Tokenized

The possibilities of tokenization go far beyond individual anime panels or manga artwork. For example, entire anime series could be converted into NFT ownership shares, while characters could be turned into NFTs with interactive features inside metaverse platforms.

NFT ownership could also be linked to staking systems, giving holders royalties as rewards.

This trend is not limited to entertainment. Tokenized IP could find its way into gaming, fintech applications, or even educational tools, creating new use cases across industries. Investors may one day hold fractional ownership of a full anime franchise, earning dividends whenever the series is licensed or distributed globally.

At the same time, fans could use NFTs as proof of fandom, unlocking access to exclusive content, merchandise, or special events.

By merging culture with finance, tokenization opens up a new dimension that benefits creators, investors, and fans alike.

Information:

Industry Precedent Kraken Meets SEC

It is important to note that Animoca and Antler’s initiative is not happening in isolation. Around the world, financial institutions and regulators are actively debating the future of tokenization.

For example, Kraken has been in discussions with the SEC about how tokenized assets could fit within traditional finance, showing how seriously the idea is being taken.

What makes the Ibex Fund different is its focus on cultural intellectual property instead of only financial products. While companies like Kraken are working on tokenized securities and investment tools, Animoca and Antler are combining entertainment with finance.

This approach creates new opportunities for fans, collectors, and cultural communities who are often outside traditional financial systems. This difference could be critical. Tokenized securities are likely to face strict regulatory limits, but tokenizing culture connects directly with a global fan economy.

That audience is already active, passionate, and increasingly comfortable with owning digital assets, which may allow projects like the Ibex Fund to scale faster and reach broader markets.